Credit Card Application Batch – 2018

During 2018, I decided to apply for 2 more credit cards as I continue to diversify & build up my point/mile balances. I applied and was approved for the following cards:

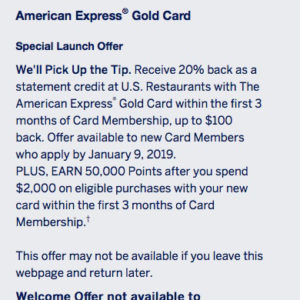

American Express Gold Card ($250/yr, not waived 1st year):

- 50,000 AMEX points after $2,000 spend in 90 days

- 20% back on US Restaurants during the first 90 days, up to $100 back

- 4X AMEX points on US Restaurants and Supermarkets (better than Chase Sapphire Reserve)

- $100 Annual Airline Fee Credit (worked for Alaska Airlines flights under $100)

- $10/month credit towards specific Dining options (ex. GrubHub)

Top Reason for Applying: To build up my AMEX points balance as they are great for ANA & Cathay Pacific redemptions. I also downgraded my Chase Sapphire Reserve to Preferred as I had too many overlapping benefits and deemed this a more valuable card to use for my Dining charges.

- AMEX Gold

American Express Starwood Luxury Card ($450/yr, not waived 1st year):

- 100,000 Marriott points after $3,000 spend in 90 days

- 6X Marriott points on Marriott & Starwood hotel stays (equivalent to 2 SPG points in the old program)

- $300 annual statement credits for purchases at Marriott & Starwood hotels

- 1 Annual Free Night (up to 50,000 points) after card renewal

- Automatic Gold status and the ability to earn Platinum after spending $75k in a calendar year

Top Reason for Applying: To build up my Marriott points balance as I’m running low due to less business travel. Given Marriott/Starwood is my primary hotel program, the annual fee is easily offset with the annual free night as $300 hotel credit towards my stays.

With these new cards in my wallet, I’m using the following cards for these spending categories:

- Airfare – AMEX Platinum (5X Points)

- Gas – Citi Costco (4% Cashback)

- Grocery – AMEX Gold (4X Points)

- Uber & Parking – Chase Sapphire Preferred (2X Points)

- US Restaurant – AMEX Gold (4X Points)

- Marriott & Starwood Hotel Stays – AMEX SPG Luxury (6X Points)

Have you applied for any new cards during 2018? Comment below.

We got the American Express Gold Card for the exact same reason – hard to beat 4X points on dining. We also opened a Chase Ink Business Cash card for phone/internet services and office supples.

The sign-up bonus is appealing for the SPG Luxury, but based on our usage we’ll need to run the numbers for the break-even point. Curious to hear about your experience with it.